What is the difference between income insurance vs redundancy insurance?

Living with no income has become a terrible reality for so many Australians in recent times. No income means no groceries in the fridge, no fuel in the car and no money to pay bills. This situation may leave many wishing they had applied for income insurance.

Income protection insurance is a form of life insurance designed to replace a portion of your income if you are not able to work due to sickness, injury or disability. You are covered for a set period of time.

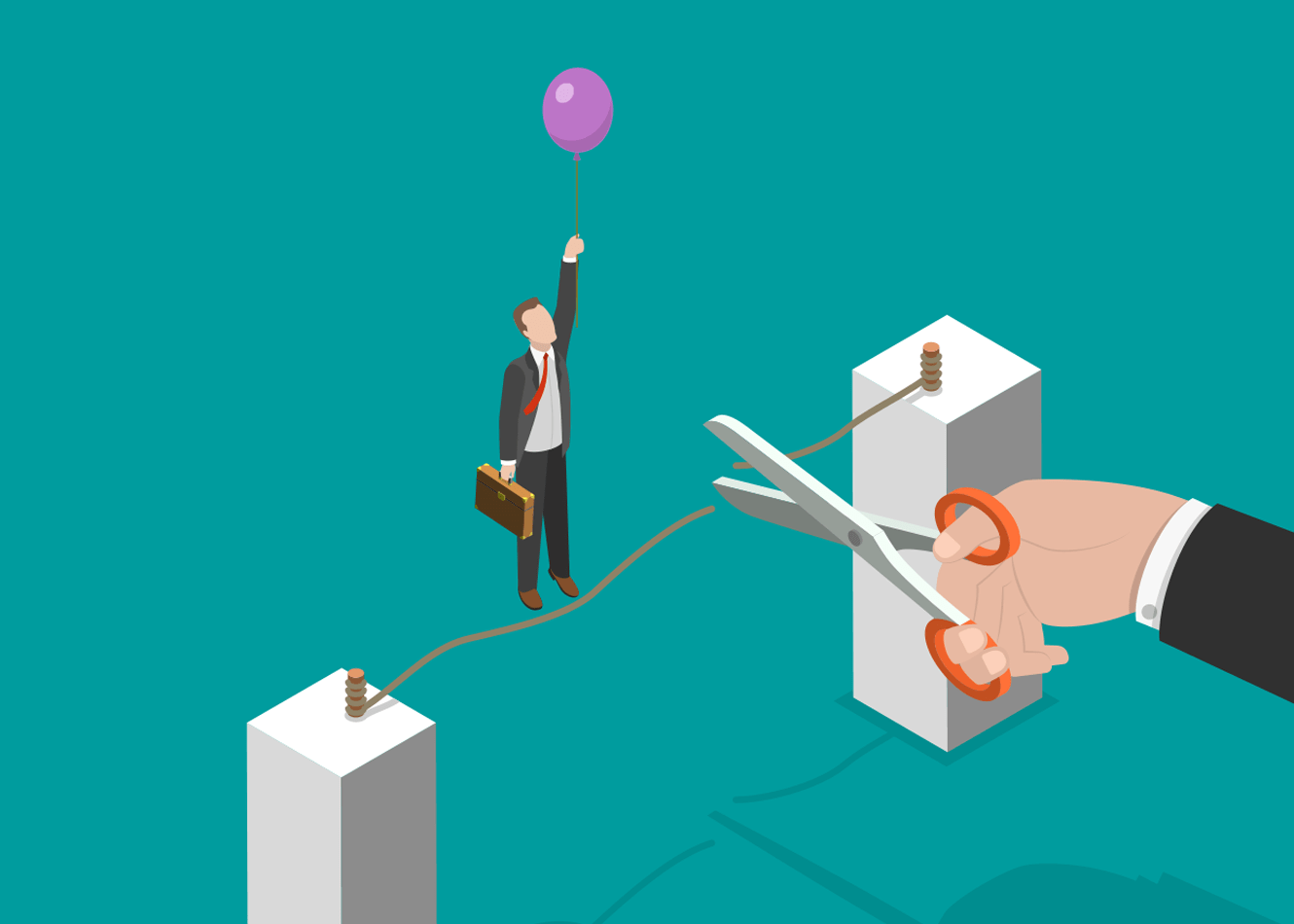

However, most income insurance policies do not cover you for involuntary redundancy. You will need to add redundancy cover or involuntary unemployment insurance as an additional extra.

Redundancy insurance or involuntary unemployment insurance has been created to offer financial assistance as a short-term option following job loss due to redundancy, or if your business becomes insolvent. It will cover a portion of your pre-redundancy income for a ‘benefit period’ while you are unemployed.

Who Should Consider Income and Redundancy Insurance?

- If you have a family that relies solely on your income.

- If You work in a high-risk industry.

- If You have a mortgage.

How much will it cost?

Income insurance, as a form of life insurance varies with providers and personal factors. Some factors include:

- Smoking status

- Gender

- Age

- Pre-existing medical conditions

- Occupation

- The amount of time you will wait before receiving benefits.

Redundancy insurance, as an added extra on top of income insurance will take all these factors into consideration and will be charged additionally. Prices again vary across providers.

What should I look out for when purchasing income insurance?

- Be very clear about what is covered and what is not as well as how much you will be paid after making a claim and what will the premiums cost?

- Consider policies that pay if you are unable to perform your regular occupation rather than any occupation you are trained for.

- Weigh up the pros and cons of agreed-value insurance vs indemnity value policies with how much your income is likely to change.

- Consider asking your super fund to negotiate a better rate for you.

What should I consider when purchasing redundancy insurance?

- You need to be working at least 30 hours a week.

- Some banks may offer redundancy insurance to customers with both a mortgage and an income protection policy, the benefits are then paid straight to the mortgage.

- The policy will likely need to be in place for at least six months before you can make a claim.

- If you have been told you are likely to be made redundant before you purchase a policy you will not be covered.

- You will typically only be paid benefits while you are unemployed or up to a maximum of three months.

- You will need to prove the redundancy was through no fault of your own.

- You will likely not be covered if you are let go during a probation period.

- Workers on a contract basis may struggle to find a provider to cover them.